How to avoid losing money

Losing money in crypto sucks big time. Today I am going to give you five ways you can avoid losing money in crypto.

Why bother stepping into crypto if you are just losing money? If you follow the right set of rules you will set yourself up for great success. Helping you achieve great wealth for yourself, your kids, and even your grandchildren.

A lot of people fail to investing in crypto because they want to get rich quick. Building a crypto portfolio at the end of a bull market will result in a bad return on investment. Some people will even see their investment drop by 95%. How come there are people who 10x their investments and there a people who lose 95% of their capital?

The key to being successful is being consistent while having a system. There are a lot of ways to do this. The following 5 points are my top picks to be more consistent while having a system:

1. Don’t invest what you can’t afford to lose

Wife: Honey, can you go to the store to get some bread? The kids are really hungry!

Me: Sorry! I used all the money to buy FTT coin and now they are delisted from the exchange.

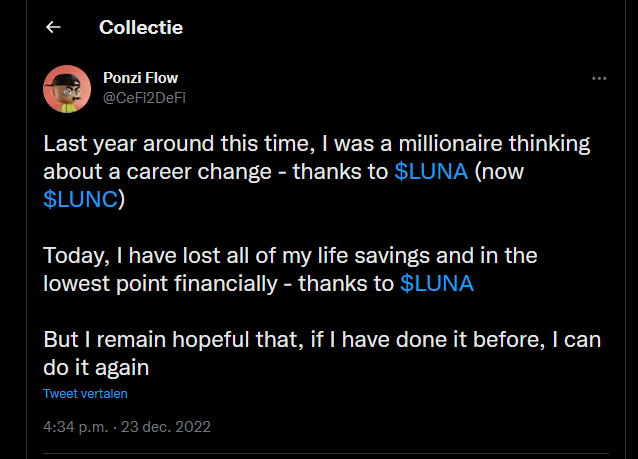

Losing money in crypto is a real risk. Please, don’t think this won’t happen to you. You can do a lot to avoid it but there is always a chance that you lose your money. There are a lot of people that ruin their life just not by following this rule. Sadly, some people commit suicide just because they lost everything in crypto. Please don’t be that person.

We all need to maintain our life. And a lot of people have more responsibilities such as their kids and spouse.

The most important rule in investing in crypto is always to invest what you can afford to lose. If you lose all your money in crypto then you still can buy bread in the store and keep your house warm.

2. Use systems to avoid trading with emotions

How can I trade without emotion? How can I live my life without having any emotional response?

You can’t.

Emotion is a part of us and they are always a part of investing. Instead of trying to remove all emotions, you are way more productive to create systems that reduce the emotions in trading.

A good system for avoiding emotion is using Dollar Cost Average (DCA). With this system, you buy every month a little bit of crypto. Instead of putting all your money directly into crypto, you are spreading it. This will make you less volatile to (big) price movements. And makes you less sensitive to Fear Of Missing Out (FOMO): like selling on a big dump or buying on a big pump. You don’t want to chase the market, you want to have systems that work.

Another system I like is having a small portion of your portfolio and investing it without any rules. For example have 10 dollars use that for all your FOMO feelings. This will address the FOMO but not risk your main portfolio.

3. Diversify your portfolio

Do you think that it won’t happen to you? That everything you invest is a success?

Look at Terra (LUNA), it went from almost $120 to under $2. Wow, that’s a great investment. Nobody was expecting that.

Building a divers portfolio makes you a lot less vulnerable. If Terra (LUNA) was 5% of your portfolio then you had a 5% loss. If you are here for the long term, a 5% loss will be well made up for in 5 or 10 years.

A diverse portfolio that has the right balance between high, mid, and low cap (in other words market capitalization) coins will gain a lot in value. You need to research and measure which balance works best for you. In a bull market, you want a different approach than in a bear market. The portfolio balance varies also on your goal with investing in crypto. Are you a more active (aggressive) investor or are you investing more passively?

For example, a great all-round portfolio is:

50% Bitcoin (BTC)

20% Ethereum (ETH)

10% Tether (USDT) (or another stable coin)

5% Polkadot (DOT)

5% Cardano (ADA)

5% Uniswap (UNI)

2% Sandbox (SAND)

2% Moonbeam (GLMR)

1% Other (Small cap for the fun)

This example has a good balance between large-caps like BTC and ETH. But also has a substantial part invested in mid-caps (DOT, ADA, UNI, SAND) and a very small part invested in low-caps (GLMR and others). The 10% tether is a part that you use DCA (dollar cost average) and to take profit.

4. Don’t buy a coin without research

Your main focus is to have a diverse portfolio that suits the market condition and your goal. How can you find the best coin for your portfolio? How can you pick the right one?

Picking the right coin is up to you. Only you. Nobody else, no not even a Twitter or Youtube guru. Eventually, you are the person who presses the buy button. It is your money, you need to do your own research.

The first thing you need to know before researching a coin is to decide what you are looking for. Are you interested in a large-, mid- or small-cap? After that there are 5 aspects I always use when researching the right coin for my portfolio:

- Fundamentals

What is the goal of the coin? What does it solve? Read the white paper and compare it to other solutions.

- Roadmap and developers

Crypto is all about solving real-world problems: building to a solution. Without developers and a roadmap, there is no future in the coin. Figure out if the project is doing this well and is frequently being updated in Github.

- Volume

Look up the coin at coinmarketcap.com and you see the volume of the last 24 hours. Make sure that the coin has value otherwise, you can’t get rid of the coin if you change your mind. This also gives you a better idea of how much activity the coin has. The more, the better.

- Purchasing method

Where can you purchase the potential coin? How many exchanges offer the coin? The more markets, the better. You can look up the coin at coinmarketcap.com and see where you can buy the coin.

- Activity

Besides volume and development, you can also look at other activities. Such as Twitter, Youtube, Telegram, Slack, and Discord. Join their group and check what people are saying about the project. Take a look at gurus and only use their advice with a grain of salt.

5. Take profit

Imagine that you purchase $10,000 worth of Cardano (ADA) on 20 January 2020 for $0.33. Now the bull cycle kicks in and your ADA (at $3) is now worth $90,000. You think: this is not going to end and we are going to a million.

Suddenly the bear market kicks in and your ADA (at $0.24) is now worth $7272,72. You now lost $2727,27.

I am not a believer in only HODL. People need to know that you can purchase coins with DCA (dollar cost average) but you can also take profit as DCA. The easiest to do this in price discovery is by taking 5% or 10% from each big number on the chart.

Let’s do the calculation for ADA again (rounding the numbers).

Investment: $10,000 = 30,303 ADA ($0,33)

Take profit 1: 10% of 30,303 ADA at $0.5 = $1,515

Take profit 2: 10% of 27,273 ADA at $1 = $2,727

Take profit 3: 10% of 24,546 ADA at $1.5 = $3,682

Take profit 4: 10% of 22,091 ADA at $2 = $4,418

Take profit 5: 10% of 19,882 ADA at $2.5 = $4,971

Take profit 6: 10% of 17,894 ADA at $3 = $5,368

Stop loss: 17,894 ADA at $1.5 = $26,841

Total profit: $49,522

After one or two take profit you can put your stop loss into profit. This way you will never lose money with the trade. I rather have effortless an almost $50,000 profit than try to time the 3-dollar top.

It is almost impossible to time the market top but you can take profit at a major level. Nobody has gone broke by taking a profit.

You are the only one who can change this.

Stop with quick wins and build a crypto portfolio that lasts. Dedicate time to make these tips work. Don’t read this and then do nothing. You will lose money over and over again. This is your time to change your thinking and make a profit.

Best of luck.

Daniel Donselaar