How to get better at long-term investing

I changed my mindset from short-term gains to long-term investing.

- A short-term goal is to make as much money as possible with big risks.

- A long-term goal is to get a good return on your investment with as little risk as possible.

Getting better at long-term investing isn’t a quick fix. I will dedicate six

newsletters to help you improve your long-term investing. This is the first in

the series.

Let’s start with the problem of short-term investing.

The problem of investing short-term

I started investing in crypto in 2018. I only invested in altcoins because

they are high-risk with high returns. In my head, I was only thinking of the

high reward. I was short-sighted. I wanted a shortcut to the big gains.

Eventually, that didn’t turn out that great. I lost some money and began to

think about my crypto journey. I love to reflect on myself and improve. So I

did that.

I came to the conclusion that I wanted a solution to my long-term problems. My long-term problems were financial freedom, buying a bigger house for my family, helping others, and making beautiful trips.

I needed to change my short-term focus to a long-term focus.

The problem with short-term focus is that it doesn’t fix your long-term

problems.

Let me list a couple of long-term problems that can be on your mind:

- Paying off your cars or upgrading your crappy car

- Paying off your house or buying a home

- Paying for your kid’s education

- Invest for (early) retirement

- Helping loved ones

You might think you can cash out massive amounts of wealth fast by going all-in with crypto in the short term.

Unfortunately, there are many cases where that just doesn’t work.

Let me share a story:

Source:

https://x.com/coinfessions/status/1851353375943901571

This guy put years of savings into meme coins. He was greedy. He wanted more from the market and was focused on the short term.

Eventually, he lost all his money with a rug pull.

A rug pull is when you invest in a coin, and suddenly, the project is abandoned.

You are left with a worthless coin.

The issues with risky situations like these are:

- You get very stressed.

- You are glued to the chart.

- You have an unsettled feeling.

- There Is a big chance you will lose money.

- You miss opportunities because you are just focusing on short-term success.

Watching your years of savings vanish in minutes by a rug pull is very

painful.

Investing is all about weighing the risks and making the right move at the right time.

So you want to invest in something with more upside potential than downside.

But, the tricky part is that you must analyze many things to determine the upsides and downsides.

These things are:

- Technical analysis

- Market research

- Fundamentals

- Tokenomics

- Social proof

- Scarcity

These analyses help you get more insight into how risky an asset is.

Putting all these ways to research a crypto coin in one newsletter is too much. So, we are going to focus only on the scarcity part.

Scarcity is the fundamental reason why crypto is booming. It’s the reason we see Bitcoin go from $100 to $75k.

Scarcity analysis is used for gold, silver, dollar, euro and all other currencies.

The golden rule with scarcity is:

The scarcer a resource, the more it’s worth.

For example, if you give someone a pure gold necklace, they won’t just throw it in the trash bin. Every person will say that gold is worth something because gold is scarce.

In crypto, there’s an asset even more scarce than gold and silver. Yeah, you guessed it.

Bitcoin.

How to measure scarcity

Plan B, a world-renowned Dutch analyst, created a model showing how rare Bitcoin and other assets are (gold, silver etc.).

This model is called stock-to-flow.

He doesn’t only show how rare Bitcoin is but also how rare it is going to be

in the future. This model is one of the best ways to predict the price of Bitcoin.

Let’s dive in.

One number to compare scarcity

Stock-to-flow is a ratio. A ratio is a single number representing the

difference between two numbers (stock and flow).

Let’s take a YouTube video as an example

A ratio of the likes-to-dislikes of a YouTube video:

- 10 likes to 1 dislike, then you have a ratio of 10 likes / 1 dislike = 10.

- 1 like to 10 dislikes, then you have a ratio of 1 like / 10 dislikes = 0.1.

If the ratio of likes to dislikes is higher (10 vs. 0.1), people tend to like the video more because you have a bigger likes-to-dislikes ratio.

The benefit of using this is that you can easily compare different videos without looking at the number of views.

Stock-to-flow ratio

Okay. Let’s get back to the stock-to-flow ratio.

- Stock = the number of assets available.

- Flow = the number of assets that can be created each year.

Let me show you some examples:

Gold

- Stock: 187,000 tons (total supply of gold at the moment)

- Flow: 3,000 tons (the mined gold per year)

- Stock/flow: 62,33

Bitcoin

- Stock: 19,171,050 Bitcoins (fixed total supply)

- Flow: 328,500 (roughly mined per year)

- Stock/flow: 58,35

Every asset class has a stock and a flow.

The stock-to-flow ratio determines if an asset is rare.

The higher the stock-to-flow, the rarer an asset class is.

For Bitcoin, the stock-to-flow ratio allows us to:

- Compare it with different types of assets.

- Forecast how rare Bitcoin will be.

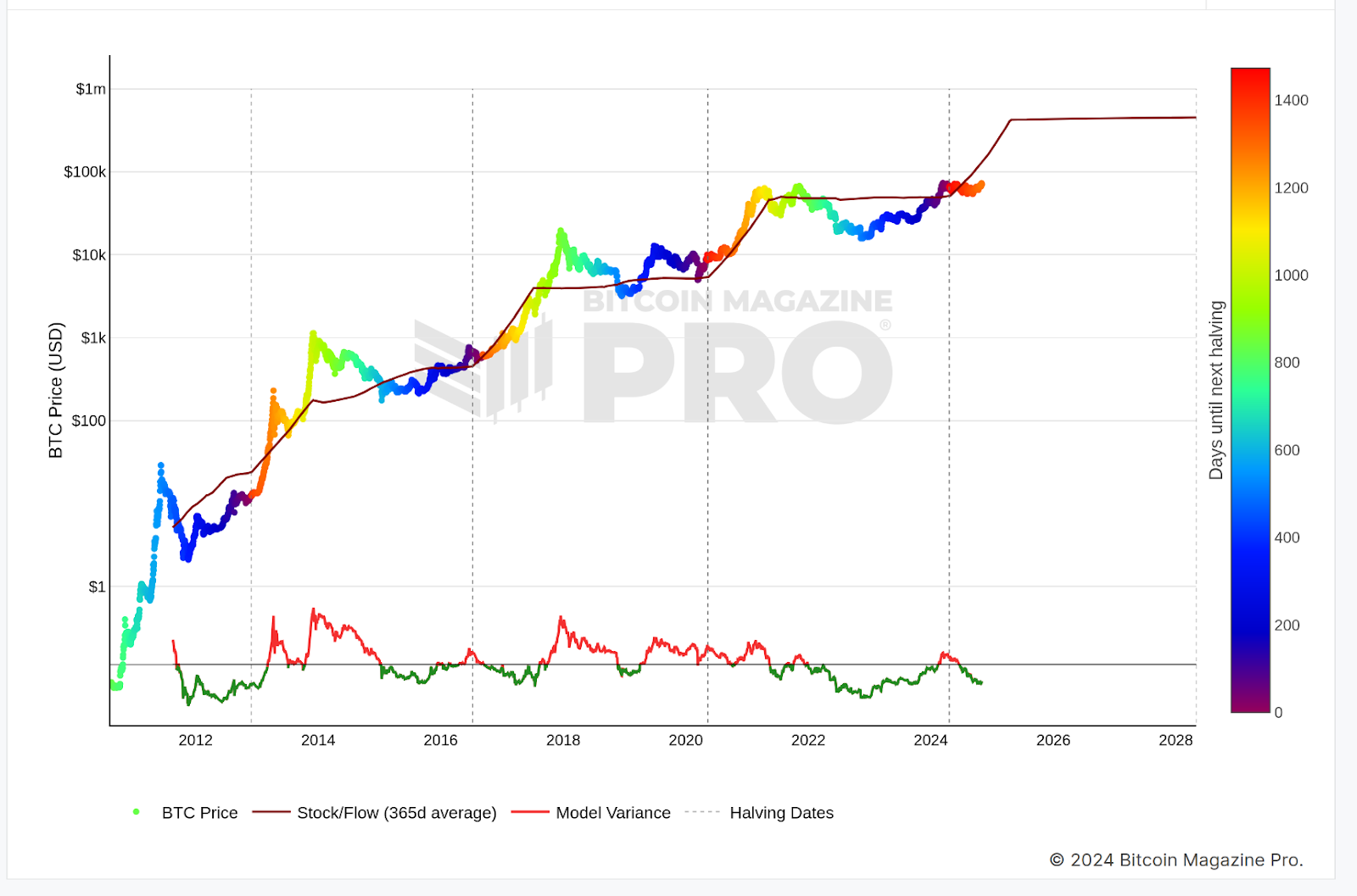

PlanB has put these two things on a chart.

We will focus solely on the Bitcoin forecast to see how Bitcoin will perform in the future.

The stock-to-flow chart

A lot is happening on this chart.

Let’s go over the most important stuff:

- The horizontal side is the years.

- The vertical side is the Bitcoin price.

- The dot is the Bitcoin price at the moment.

- The color in the dot represents the days before the Bitcoin halving.

- The brownish line is the stock/flow.

We see that the price of Bitcoin has been going up over time.

This is mainly because Bitcoin has become a rarer asset.

Bitcoin is becoming more scarce

The fact is that the maximum amount of Bitcoin (stock) is fixed. This is defined in the Bitcoin source code. Bitcoin is becoming rarer. This is because the amount of Bitcoins created yearly decreases due to the halving. Mined Bitcoin is the flow in the stock-to-flow calculation.

When you decrease the flow and the stock remains the same, Bitcoin becomes a rarer asset.

The Bitcoin halving is built into the source code of Bitcoin. When a halving occurs, it reduces the amount of Bitcoin mined every 4 years.

If you look at the chart, you see a vertical dotted line. That is the halving.

Halving and long-term investing

The halving helps determine a good moment to buy and sell in combination with

stock-to-flow.

The stock-to-flow ratio increases after the halving. The result: the price pumps. If you look at the chart, you see that the price increases after each dotted line.

Based on this information, you can invest in Bitcoin long-term. You can see the best time for investing and when it’s better to stop and sell.

Altcoins and the Bitcoin stock-to-flow model

Bitcoin is a leading coin in crypto. So if Bitcoin pumps normally, altcoins pump too. They follow the Bitcoin trend but tend to overreact on pumps and dumps. You can use this stock-to-flow to determine when to invest in altcoins and sell.

Of course, I won’t tell you when to buy and sell. That’s your responsibility.

You must investigate the chart and pinpoint the right moment to dollar cost average (DCA) in the market.

The stock-to-flow chart will help you plan for the long term and can guide you in this volatile market.

I want to challenge you to research the stock-to-flow chart and determine the best investment moment. Look at the previous pumps and dumps. Write down when to start DCA-ing into crypto. Write down when to exit.

Remember, the more you know, the better you can pick the right moment to invest.

Always think long-term.

Be the hero of your own crypto journey, and stay safe.

Dan John

P.S. This is not financial advice. Please use this as an educational source.

You are solely responsible for making your own decisions when investing in crypto. You can have great wins but also great losses.