Many crypto projects aren’t worth your money. They are not made for investors but for the coin’s creators. To make them rich and move your hard-earned money to their crypto wallet.

Last week, I was researching new projects. I always get a kick out of

researching coins promoted by influencers. Some projects are good, many are bad.

The coin I researched last week was $CCAP. It’s a native token based on the website https://www.coinratecap.com/.

Man, I saw a lot of red flags with this project. I’m not saying this project won’t do well in a bull run, but I don’t expect it.

I read the whitepaper and judged it like a jury on a TV show.

Researching a whitepaper is a crucial part of doing your research in crypto.

It separates the winners from the losers: from projects that do 20x to projects that will eat up all your investments.

You are responsible for the crypto coin you invest in. The better you get at it, the more profit you will make.

To research a whitepaper fast, you need to validate if a project is junk or gold within minutes.

We humans are very good at being negative and seeing the bad stuff. That’s why the best approach is to look for red flags.

Red flags are things that are a no-go. You directly quit research if you find a red flag.

I will show you 3 red flags when researching a crypto whitepaper:

1. Unclear goal

A poor whitepaper does not have a clear goal. Its problem isn’t big enough and is often only geared towards the team’s benefits, not investors and end customers.

Example of an unclear goal:

Source: CCAT whitepaper

The problem that CCAT wants to solve can be solved by just putting an upvote system on the website:

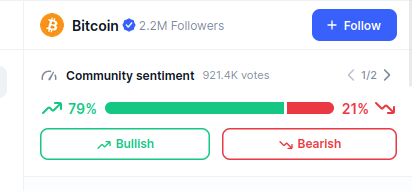

Source: https://coinmarketcap.com/currencies/bitcoin/

Empowering the community through rewards is just giving the community crypto coins. Making the coin worth less because everyone is getting free coins.

In their vision, they want to create a leading platform. However, the only people who will benefit are the team, not the investors.

They don’t explain how they want to help and solve existing problems.

Reading through a whitepaper can give you a clear idea of what a project aims to achieve. If it’s a bad-quality whitepaper, just skip the project. It isn’t worth your time and money.

2. No team members

Another red flag is if there are no team members. If a project’s whitepaper does not contain team members, you can alternatively research the website. If you can’t find any members on their website, stop researching.

Projects can’t achieve anything without people. People are the cornerstone of a good crypto project.

Some projects have team members, but they are masked or anonymous. I would say

that this is a yellow flag. A person like Satoshi is trustworthy because his history shows he knows much about blockchain and crypto. If you can’t validate the people behind a project, it’s a red flag.

Look for LinkedIn profiles and search for the people who are responsible for the project.

The more you know, the better you can say if a project is good.

3. Bad roadmap

The last red flag is a lousy roadmap. A roadmap creates clarity. The roadmap is the team’s statement of how they will fix the problem in their whitepaper.

A good roadmap has clear goals and ultimately creates value. If you are an investor, a roadmap gives you confidence that the team will do it.

A red flag is a missing roadmap or a roadmap that doesn’t fix the goal. A roadmap with some random features that have nothing to do with the project.

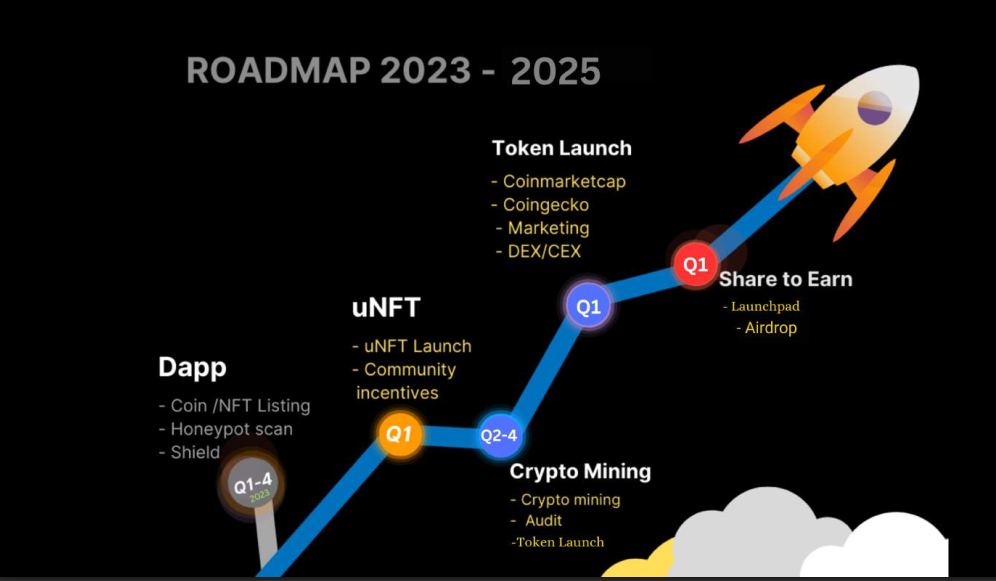

Example of a bad roadmap:

Source: CCAT whitepaper

The problem with this roadmap is that it doesn’t solve any problems. It only lists all the generic coin features, such as coin listing, NFT, mining, token launch, and airdrops. This roadmap has no new features; it is just generic work.

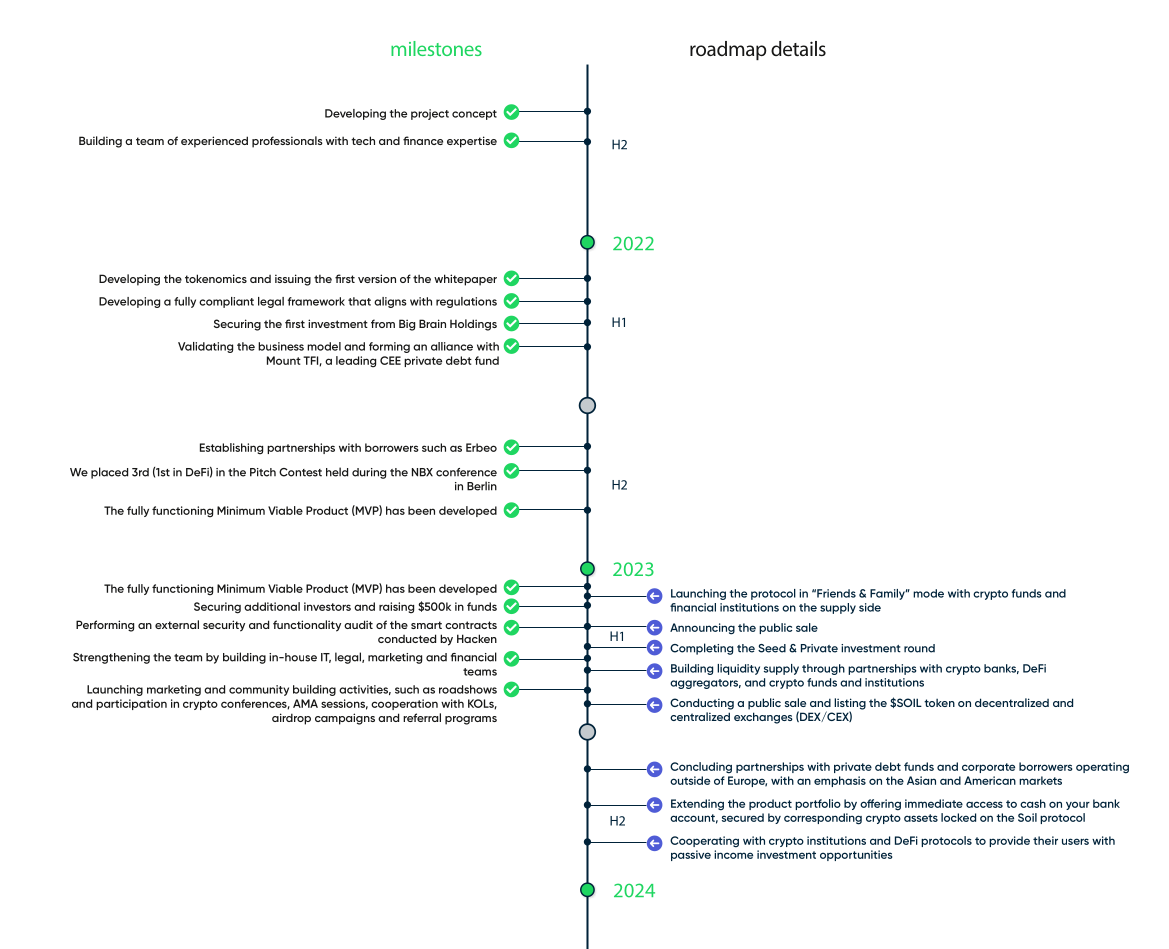

Example of a good roadmap:

Source: SOIL whitepaper

This roadmap has details and shows how the project will keep its promise. You see that they work with very clear and professional milestones. Look for projects with a clear roadmap; that’s definitely a green flag.

That’s it for this week.

A profitable investor minimizes losses.

Always watch out for scammy projects with these red flags.

Be the hero of your own crypto journey, and stay safe.

Dan John