How set up a diverse crypto portfolio

Today I am going to teach you how to create a diverse portfolio. By creating a diverse portfolio you reduce risk, emotions and maximize profit.

Reduce Risk

If you have 5 to 10 coins in your portfolio the chance that all the coins will fail is unlikely. There is a chance that some coins will fail. You hedge against that coin that didn’t work out. Knowing that coins fail will make your portfolio stronger.

Less emotions

Dollar Cost Averaging (DCA) will make you less emotional because you buy crypto every month or week. This cuts out the emotion because buying a coin is not based on the price action.

Splitting the DCA buy into multiple coins will make you even less emotional because you won’t be affected to the price action of one coin. Multiple coins will hedge each other: if one coin drops hard due to some news, the other will stay stable.

Maximize profit

A diverse portfolio holds coins that are in multiple types of crypto spaces. Examples of crypto spaces are Layer 1 coins (BTC, LTC etc.), DeFi, utility tokes, meme coins but also privacy coins. Each has its pros and cons but eventually, there is a supply and demand.

When you do good research and stacked up some coins that come popular in some years, you will have some great returns on investments. For example, DeFi coins were very popular before and they outperformed many other assets.

Building a diverse crypto portfolio helps you invest in a stable crypto portfolio. Let me show you my steps:

Step 1: Figure out the sentiment of the market.

The first step you need to do is figure out if we are in a bull, bear, or sideways market. You can do this by opening Trading View, going to bitcoin, and going to the daily time frame.

Bull market:

People are optimistic in a bull market. Everybody expects a higher price. Each pullback in price action is higher (higher lows). The above images show you that we’re moving upwards.

Bear market:

People are negative in a bear market. People expect lower prices. From the above chart you see that after each pump we dump harder (lower highs).

Side ways market:

A sideways market is an easy market to predict. The market is normally going slow. Not many people talk about crypto. Price is moving within a range and we have a clear top and bottom. The top part is over bought: people payed too much. Bottom part is over sold: people payed too less for their coin. Each time we go too far up or too far down the price tends to go to the fair value.

You need to know that market condition because having the wrong portfolio in a specific market condition will result in a big loss.

- At the start of a bull market you want to be more riskier and have more alt coins in your portfolio.

- At the start of a bear market you want to have more defensive portfolio with stable coins and bitcoin in your portfolio.

- In a side ways market you want to have balanced portfolio. Side ways markets tend to happen after a big move. Like just after a bear market.

Let’s say you start investing in a bull market.

Bull market (higher highs and optimism)

- Start DCA on a riskier portfolio and take profit very fast

- Taking profits will result in more stablecoins and bitcoin

The bear market begins (lower highs and negativity)

- Continuing with DCA with a defensive portfolio

- Take time to research new coins

- Move slowly to a balanced portfolio

A bear market is going on for a while and the market is boring with a lot of sideways action

- Continuing with DCA with a balanced portfolio

- Use your researched coins and move to a riskier portfolio

The bull market starts and people are getting more optimistic.

- Continue DCA but now take profit on the coins you bought in the bear/sideways market

- Slowly move to a more defensive portfolio

Step 2: Choose the portfolio template

Building a portfolio requires research. Below I’ve created multiple templates on how you can create a portfolio. Depending on the market condition you want to move in and out of stable coins. It’s a game of taking profit and DCA into the market.

These templates are my point for view. Feel free to create your own template.

Defensive portfolio:

50% Stable coins

40% BTC

5% ETH

5% Top 5 coins

Balanced portfolio:

25% Stable coins

30% BTC

15% ETH

20% Top 5 coins

10% Top 50 coins

Riskier portfolio:

5% Stable coins

25% BTC

15% ETH

10% Top 5 coin

10% Top 10 coin

10% Top 50 coin

10% Top 100 coin

5% Top 250 coin 1

5% Top 250 coin 2

2.5% Top 500 coin 1

2.5% Top 500 coin 2

Step 3: Research coins based on their marketcap

Based on the market sentiment you picked a portfolio to DCA. Now you need to pick the coins for that portfolio.

I mostly use https://coinmarketcap.com for selecting the right coins. The coins are ordered by market cap. Bitcoin is number 1 and Ethereum number 2 etc.

In a previous edition of my newsletter “how to avoid losing money” I explain that you always need to research a coin before buying. To purchase the right coin for your portfolio you need to look the following aspects of a coin:

- Fundamentals – Goal of the coin and white paper research

- Roadmap and developers – What are they trying to solve? How big is the team?

- Volume – How much are people trading the coin?

- Purchasing method – How can I buy the coin? Which exchanges?

- Activity – How active are they on social media and other platforms like Discord and Youtube?

Step 4: Make a DCA plan

Oke, now you have a list of coins you going to purchase because you did awesome research.

We are going to work on a DCA plan:

What is the interval of my DCA?

Are you going to buy the coins every: week, 2 weeks, month?

How much am I going to invest each time?

The amount depends on what your comfortable with.

Never invest more then you are willing to lose. Always have a 3 to 6 months of emergency funds in place.

For example you can invest 5% of your monthly take home pay. If you earn $2000 per month then that’s $100 a month for DCA.

What are the purchasing steps for each investment moment?

You know when and how much you are going to invest. Now you need to know the steps you need to take to purchase the coins.

I recommend to automatically write of your credit card of bank account each month (or other time frame). This way you will never forget it. Coinbase has great ways to automate this.

But also for the European people, you can use Bitvavo.

After automatic sending money to the exchange you need to have a plan to purchase the coins. Some exchange can automatically do this. I rather do this manually and send it to my cold storage.

Step 5: Create insights of your investment

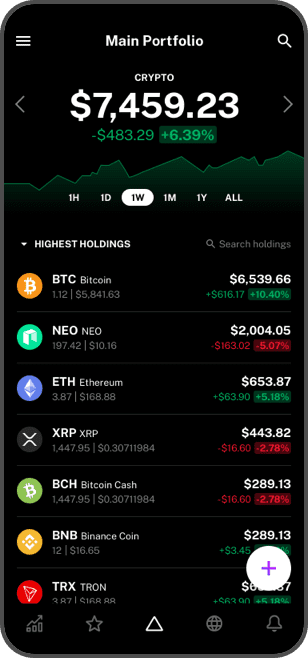

Now you setup a diverse crypto portfolio. It’s important to track your investment. I personally use Delta app. This is an example of a portfolio.

I like it because you can see your initial investment and the profit or loss based on that investment.

Building a diverse crypto portfolio is not easy. You need to research but also know the market conditions. But doing the right will provide generational wealth for you and your kids (if you have any).

Stay safe and best of luck.

Daniel Donselaar