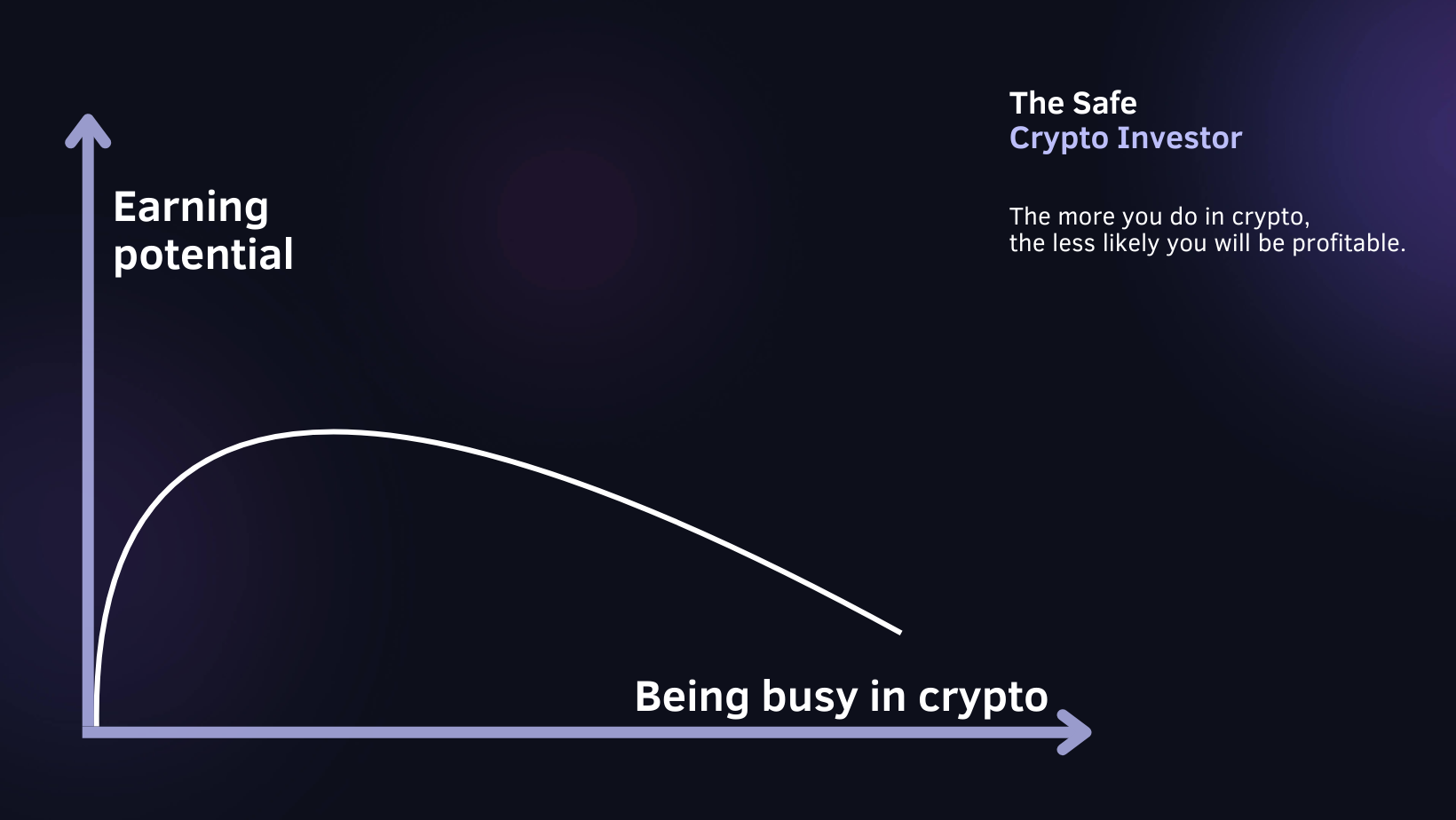

To be profitable, do you need to spend 10 hours a week in crypto?

If you spend more time in crypto, will you earn more money?

The answer to these questions is as short as it is simple.

No.

Many people lose money in crypto because they are doing too much.

They are overworking.

Overworking looks like this:

- Selling with every dump.

- Buying with every pump.

- Trading every meme coin.

- 1000 coins in your portfolio.

- Sticking to the chart 24/7.

And last but certainly not least:

- Going all in with leverage trading. And then? Blaming crypto for your loss.

Are you overworking? I certainly was at some point in 2019, I experienced a

loss in crypto because of it.

I followed influencers like Bitboy Crypto. Every time he posted a video of a

coin, I tried to get in as quickly as possible.

It was a hidden pump and dump. An influencer put out a video, and people

pumped the price.

Eventually, it fell and a lot of people lost their money.

I did too. I gained and lost money. It was a rollercoaster. It was shady, and

I got sick of it.

After that, you’d think I’d learned my lesson.

Nope.

I invested in many coins without any good research and based on the hype.

I would’ve had more profit if I had:

– invested slowly in Bitcoin and Ethereum.

– stopped the FOMO.

– managed the risk of altcoins.

– done my own research.

I realized this wasn’t the way to go.

I needed to change. That change started when I transitioned from investing

based on emotions to investing using systems.

Today, I automatically invest in Bitcoin, Ethereum and other alts.

I use systems and templates to do my research and invest.

My focus is only long-term.

Not quick wins.

If you want to be in crypto for the long run you need to stop being part of

pump and dumps and forget about chasing the next big thing.

Today, I will show you how to do just that. I’ll show you 5 ways to do less

and earn more in crypto. 5 ways to chill-out and plan for the long term.

1. Know the market cycles

The crypto market works in cycles. It’s not always up. It’s not always down.

There is a trend.

One old saying with investing is:

The trend is your friend until the end.

The trend being your friend means that you need to trade with the trend.

There are roughly 4 phases in a cycle, and each has its own way of working:

- Bull market: Buy the dips

- Distribution phase: Take profit on most coins

- Bear market: Sell the tops

- Accumulation phase: DCA into project

The bare minimum of doing less is knowing in which cycle you are.

If you are in a bear market, don’t buy coins. You are just catching knives.

You can do something else if the market isn’t ready to enter.

2. Dollar-cost average (DCA)

Dollar-cost averaging (DCA) is an amazing way to numb the craziness of the

crypto market.

With DCA, you slowly invest in a project.

After you have done research for a crypto coin, you slowly invest in that

project.

You can invest $10 every two weeks and do that for a year.

This way, you get the average price of that coin in one year.

It’s not the top.

It’s not the bottom.

It’s just a good price for that asset.

DCA helps you to avoid:

- FOMO

- Time the bottom

- Time the top

It removes your emotions from the equation. It’s (almost) carefree investing.

No emotions mean you are not glued to the screen because you put all your

money into a stupid meme coin that dropped by 80%.

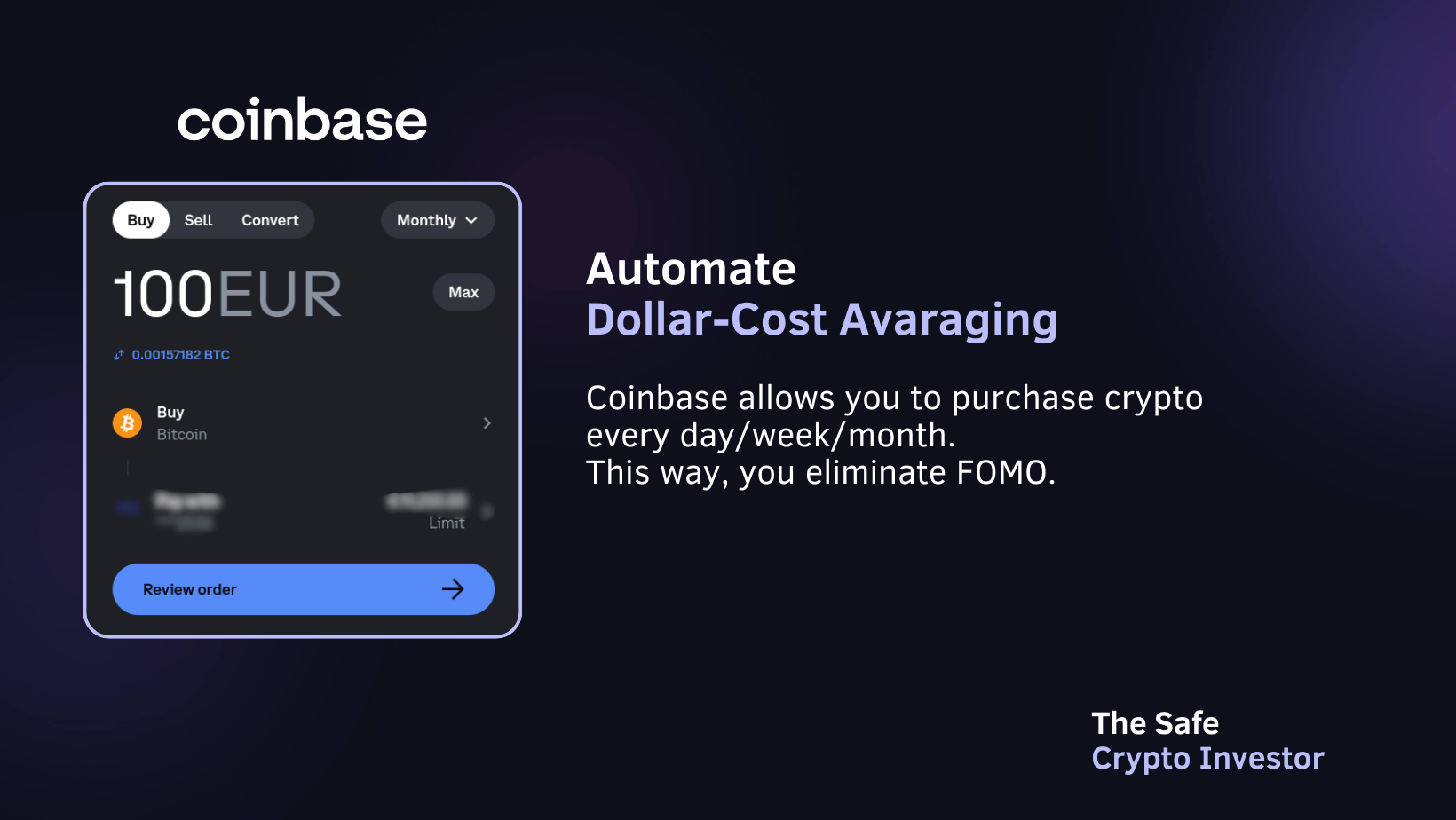

3. Automate everything

A great way to save time is to automate everything you can.

The first step in your automation journey is to automate DCA.

Most exchanges allow you to automate purchasing crypto.

My favorite exchange for doing this is @coinbase.

You simply go to Coinbase and go to the buy & sell section.

Change ‘One-time order’ to ‘Recurring buy.’

Very simple and very effective.

Other great ways to automate are:

- Use a news aggregator: combine news for your daily/weekly

- Stake coins and reinvest them back into staking

- Use trading bots to automate trading (can be very risky)

4. Use templates

Using templates for everything saves so much time.

I use templates for:

- Technical analysis

- Shortlisting new tokens

- Doing full research of tokens on my shortlist

- Finding out if someone DM/emails me a scam

A template saves time because you don’t have to think about how to do

something.

You just need to fill in the blanks.

Doing full research is easy because I fill in my list of questions and

eventually get a score. That score tells me if a project is profitable.

5. Use take profit level

The last tip is about taking profit when things get hot in crypto.

Taking profit (TP) needs to be as easy as possible.

Do this:

- Put the realistic TP levels on the chart

- Below that line, put a TradingView alert

- Make a plan for how much percentage you will get out of the market.

- Make a list per coin of what you need to do to make a profit. (Go to x exchange, etc.)

- When you get an alert, you execute your TP todo list.

Taking profit should be a no-brainer; do it without emotions.

Don’t let greed kick in.

You will get burned.

That’s it, guys.

The key takeaway is that you must build systems to avoid excessive market

time.

Systems avoid FOMO and bad decisions and will save you precious time.