I bought the top in December 2017, and that was a mistake. Bitcoin price was then almost 20k, and it fell like a rock, and I sold with a loss.

This purchase was the first BTC I have ever bought. I was hyped by the people surrounding me. “BTC will only go up. People had massive gains, so that was a good reason (at that moment) to buy.

The Bitcoin price was 68k in 2022. So was it a mistake? Why did it feel like a mistake to me?

Investing in crypto based on feelings is a bad idea

My mistake was that I made a trade based on my feelings.

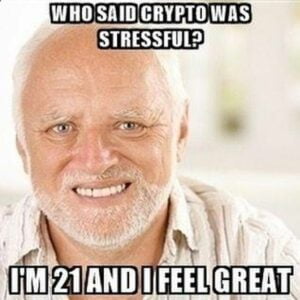

Feelings are good for a relationship and making life decisions. Listening to your emotions while trading and investing in crypto will do more harm than good. Chasing the price will eventually bring you to your knees. Many people lose money due to Fear Of Missing Out (FOMO).

The problem isn’t buying the top of $20k in 2017. The problem is buying with too much emotion. Too much fear.

Take control over your future in crypto. You want to grow your assets steadily, with no emotional buys, and you don’t want to look at the charts daily and regret your trade. FOMO can take not only your money but also your relationships and, for some people, even their life.

You can change and stop lousy investment habits. I will give you three actionable tips to take back control in investing in crypto.

1. Identify FOMO

The first step in eliminating FOMO is identifying it. You first need to know what FOMO feels like. FOMO is based on feelings, so this can feel different for everyone. You need to look deep into yourself and identify what triggered your FOMO.

Generally, these are the most common triggers:

- You heard that a crypto asset gained a lot of percentages quickly.

- You need to trade a crypto asset because it has gained popularity.

- Endless calculating how much you can make on a trade.

- Trading based on social media exposure.

- Trying to win back a loss without considering the risk (Revenge trading)

What triggers you to FOMO in crypto? Please write it down and look at it for every trade you make.

2. Write down a list of facts

Only identifying FOMO does not fully calm you down. What will keep you from FOMO-ing into a coin?

A great tool that can keep your head straight is a fact sheet. You can use the fact sheet as a checklist for every trade. You can check if your trade aligns with what you put on the fact sheet. For example:

- Bitcoin is cyclical: There is a bull market, a bear market, and a sideways market. A coin is not going up forever. What are the market conditions now? Am I trading accordingly to the market condition?

- I want to make money over time steadily. What am I trying to do with my trade now?

- I only invest what I am willing to lose. Which money am I investing in my trade now?

- I always do research before investing in a coin. Did I research the current coin?

- I am human, and I can be wrong. What will happen to my portfolio if this trade does not go as I think?

- When trading, I always use a stop loss. What am I willing to lose with this trade?

- I spread my purchase instead of one buy. Is this trade part of my plan? (See tip #3 for more)

You can add and remove facts from the list to suit your rules.

Having a set of rules as a checklist will help you become less vulnerable to FOMO. Always looking at this list will help you greatly when you invest in crypto.

3. Have a plan

The ultimate fix against FOMO is having a plan. A plan keeps everything simple. If you feel FOMO, ask yourself: “Is this trade part of my plan?”. If you say no, then you need to stop trading.

A good trading plan results in a good return on investment (ROI) in the long run. I recommend that most people use a dollar-cost average (DCA) trading plan. A great thing about DCA is that you can automate this process. This way, you remove all the emotions in trading. And removing emotions will remove stupid FOMO decisions.

Let me provide a list of steps to create a crypto trading/investing plan:

- Define your goals: Figure out your investment goals, such as long-term growth and income generation (through staking).

- Use risk management: Evaluate your risk tolerance and determine the level of risk you are comfortable taking in your crypto investments. Ask yourself: how much am I willing to lose?

- Diversify your portfolio: Spread your investments across different cryptocurrencies, assets, and strategies to minimize any single investment’s impact. I explained this in more detail in a previous issue of Saturday Safety Newsletter: “How to set up a diverse crypto portfolio”.

- Allocate your funds: Determine how much of your income you want to allocate to crypto investments. Make sure it is never more than you are willing to lose.

- Do research: Invest your time in researching the market, including market trends, regulatory changes, and technological developments in the crypto industry.

- Choose your investments: Based on your research, select the cryptocurrencies and strategies that align with your investment goals.

- Set a timeline: I recommend most people stick to crypto for the long term. Starting at the end of a bull market can be very demotivated. A timeline of more than five years will give you more peace of mind.

- Review and adjust: Markets can change, and the future is never clear. Regularly review your investment portfolio and make any adjustments to align to improve your return on investment (ROI).

Although these steps make you less vulnerable to FOMO, it is still a strong emotion. Keeping other parts of your life in line will help you a lot. For example:

- Having peace of mind with Faith

- Working out

- Having great relations

- Having a six-month emergency fund

Even then, FOMO can kick in. If you still can’t resist it. Try to purchase the coin with a tiny amount. For example, 10 dollars. This way, you won’t lose a lot if it goes wrong.

The key to the game is to have a good return on invest in the long run. Not a quick win.

Stay safe, and best of luck.

Daniel Donselaar